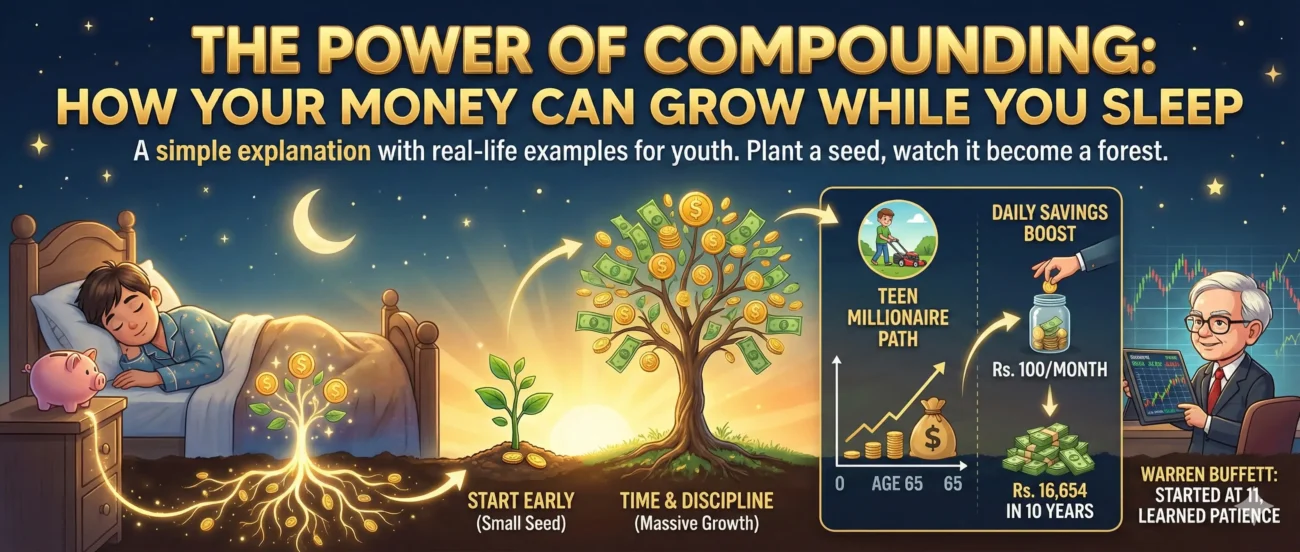

The Power of Compounding: How Your Money Can Grow While You Sleep

A simple explanation with real-life examples for youth.

Most young people believe that building wealth requires a high salary or a large amount of money. In reality, one of the most powerful tools for growing wealth is simple and available to everyone. It is called compounding. Once understood, it can completely change how money is viewed and used.

Imagine planting a tiny seed that grows into a massive tree over time. That’s compounding in a nutshell—it’s when your money earns money, and then that new money earns even more. It’s often called “money growing while you sleep” because once you invest or save, the growth continues automatically.

In simple terms, compounding means earning profit not only on the original amount but also on the profit it has already earned. In other words, money starts making money, and that money, in turn, makes more money.

That is why people often say, “Let your money work for you.”

Why Compounding?

Let’s break it down with a simple example. Suppose you stash Rs. 1,000 in an account earning 5% profit for 10 years.

- With simple profit (no compounding), you earn only on the original Rs.1,000. You’d end up with Rs.1,500 (Rs. 500 in profit).

- With compounding (assuming it compounds annually), you earn profit on the growing amount each year. You’d end up with about Rs. 1,629 total (over Rs. 629 in profit).

See how compounding adds an extra Rs. 129 without any additional effort on your part? Over longer periods, this difference becomes increasingly pronounced.

Why Starting Young?

As a young person, time is your greatest ally. Even small amounts saved now can grow into a fortune later because compounding has more years to work its magic. Let’s look at two friends:

- Sahil (Friend A) starts at age 25: Saves Rs. 200 a month for just 10 years (total saved: Rs. 24,000), then stops but lets the money grow at 7% annual return until age 65.

- Suhas (Friend B) starts at age 35: Saves Rs. 200 a month for 30 years (total saved: Rs. 72,000) until age 65, also at 7% return.

Result? Friend A ends up with about Rs. 281,000, while Friend B has around Rs. 244,000. Friend A saved far less but ended up with more—thanks to those extra 10 years of compounding. This is a classic example inspired by real investing stories.

Daily-Life Examples

Compounding isn’t just a theory; it has changed lives. Here are a few relatable stories:

- The Teen Millionaire Path: Imagine a 15-year-old who starts putting Rs. 25 a week (about Rs. 100 a month) into a retirement account, earning an average 7-10% return in the stock market. By age 65, that could grow to over Rs. 1 million, even if they stop contributing later. Real teens have done this by mowing lawns, tutoring, and investing early. This teaches kids to prioritize saving and investing by skipping fancy ice cream.

- Sareeta’s Rs. 1,000 Magic: At age 20, Sareeta invests Rs. 1,000 in a stock fund with a 7% compound return. She forgets about it until retirement at the age of 70. That Rs. 1,000 could balloon to over Rs. 29,457—purely from compounding over 50 years. It’s like turning a pizza night’s worth of cash into a down payment on a car decades later.

- Kids Who Saved Smart: True stories include a boy who saved his allowance in a bank account starting at age 8. By 18, he had enough for college books. Another family story: Siblings invested birthday money in stocks and grew it into funds for their first cars. Small habits like this show how pocket money can compound into real freedom.

- Everyday Savings Boost: Put Rs.100 a month in a high-yield savings account at 6% profit. In 10 years, you’d have about Rs. 16,654—not just the Rs.12,000 you put in, but an extra Rs. 4,654 from compounding.

Famous investor Warren Buffett began buying stocks at the age of 11, which taught him valuable lessons in patience, and compounding turned his early moves into billions. The key? He gave it time.

Tips to Get Started

- Start early, even with small amounts.

- Open a savings account in a bank that invests your spare amount.

- Save regularly, monthly if possible.

- Reinvest your profits, do not spend them.

- Learn about mutual funds (safe ways to invest in the stock market).

- Avoid debt that works against you, such as credit card interest.

Final Thought

Compounding is like planting a seed.

At first, nothing seems to happen.

But over time, it grows silently and strongly.

Your money can grow while you sleep, study, or enjoy life —

if you give it time and discipline.

The best day to start was yesterday.

The next-best day is today.

MashaaAllah very easy way to convey the message 💗 may Allah bless you sir ,