Saving vs Investing: A New Year’s Guide to Building Your Future

Helping young people understand long-term wealth building.

Imagine starting your day on January 1, 2026, with a warm cup of coffee in hand, watching the early-morning sun, and feeling excited about the year ahead. It’s the perfect moment to reflect on your financial goals and how to achieve them. Where do you want to be financially one year from now? Big financial journeys start with small, right decisions.

As we kick off 2026, many people are making promises to themselves—visiting the gym more, eating better, or finally getting their finances in order. Think about a calm New Year’s Day: you’re relaxing at home, maybe with family, dreaming of financial peace, like owning a home, traveling freely, or retiring comfortably. But a big question pops up: Should you save your money safely or invest it to grow?

This guide breaks down the difference between saving and investing in simple terms, making it perfect for beginners. We’ll cover what they mean, how they’re different, the pros and cons, how to pick what’s right for you, easy starting tips, and what to watch for this year. Backed by fresh data, this will help you turn those small choices into real wealth.

What Is Saving? Your Safety Net for Money

Saving means putting money aside in safe places where it earns a little interest with little risk. Consider bank accounts such as regular savings, high-yield CDs (certificates of deposit), or money market accounts. The government usually protects them, and your money stays safe.

In 2026, with inflation around 6% in Pakistan, saving helps protect your money from losing value. High-yield accounts are available, with rates up to 9.50% per year as of late 2025. These rates beat inflation, so your savings grow. Rates may change based on State Bank’s decisions, so check frequently.

Here’s a table of a few top Pakistani high-yield savings accounts from December 2025 data:

| Bank / Account | Approx Profit / Rate (Annual) | Minimum Deposit / Balance | Fees / Notes |

| National Bank of Pakistan (NBP) – PLS Savings | ~9.50% (indicative profit) | No specific minimum (varies) | No monthly fees for basic savings; profit paid semi-annually; PLS profit shared. |

| Habib Bank Ltd (HBL) – PLS Savings | ~9.50% base PLS (effective ~9.73%) | No minimum balance required | No monthly maintenance fee; unlimited transactions; profit credited semi-annually. |

| Bank Alfalah – PLS Savings / Alfa Savings | ~9.50%+ (tiered up to ~9.75%) | No strict minimum; profit tied to balance tiers | Profit paid monthly on average balances; typical bank charges apply. |

| Bank AL Habib – PLS Savings | ~9.50% | No minimum balance required | Monthly profit payout, free debit card, standard schedule of charges. |

| United Bank Ltd (UBL) – Savings / PLS | ~9.50% indicative PLS | No minimum specified publicly | Standard savings with profit sharing (actual profit rate varies by pool dynamics). |

| MCB Bank – Savings Accounts (e.g., Asaan / Young Saver) | ~9.50% (PLS) | Low / no minimum | Profit on average balance; typical bank charges apply. |

Saving works best for short-term goals, such as building an emergency fund (3-6 months of expenses), saving for a car, or an investment.

What Is Investing? Growing Your Money Over Time

Investing means putting your money to work so it can grow over time. Instead of keeping money only in a savings account, you use it to buy things like shares of companies (stocks), government or company loans (bonds), investment funds (mutual funds or ETFs), or property (real estate). The goal is simple: to earn more money in the future.

When you invest, your money can grow in two main ways. First, the value of your investment may rise. For example, a share you bought for a small amount today may be worth much more in several years. Second, investments can provide regular income, such as dividends from companies or rent from property.

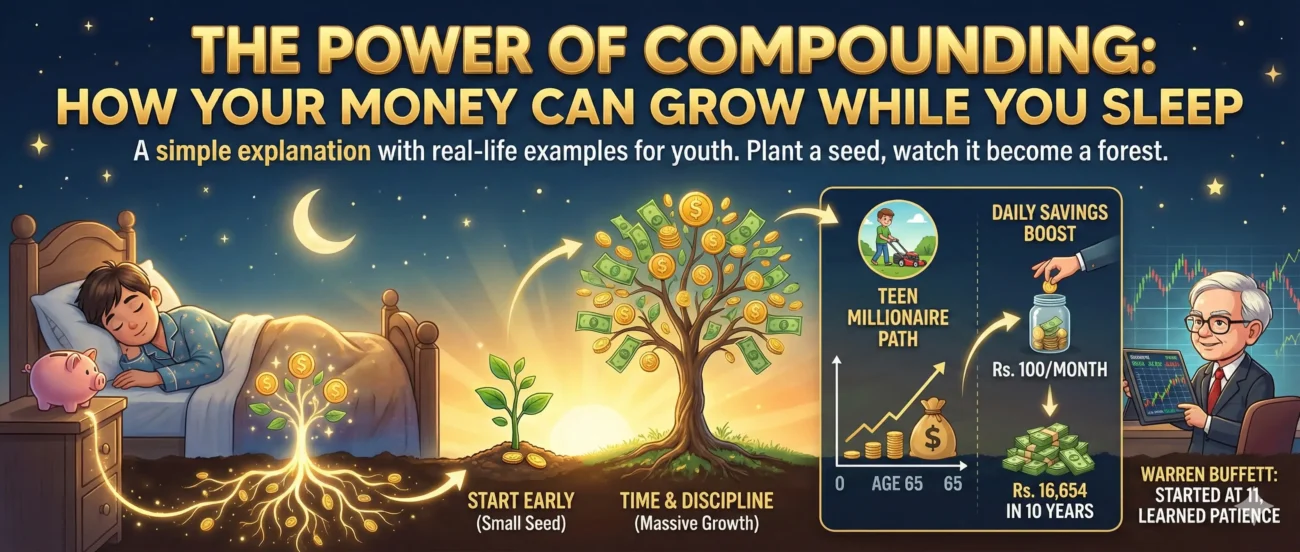

Investing isn’t risk-free. Prices can fluctuate, and in some cases, you may experience short-term losses. That is why investing is usually better suited to long-term goals, such as education, buying a home, or retirement. Over many years, however, investing has often yielded better returns than simply saving money, especially through growth and compounding.

In simple terms, investing is about patience. You accept some ups and downs today, so your money has a better chance to grow and support you in the future.

How Saving and Investing Differ

Both build wealth, but in different ways. Saving is simple and safe; investing requires more thought but can reward patience.

| Aspect | Saving | Investing |

| Risk | Very low (protected) | Higher, can lose money |

| Returns | Modest | Potential 10-18% or more |

| When to Use | Short-term (1-5 years) | Long-term (5+ years) |

| Access | Easy and quick | Good, but value changes |

| Beats Inflation | Somewhat | Better long-term |

| Effort | Low | Higher, learn the basics |

| Costs | Few fees | Possible fees/taxes |

Good and Bad Sides

Saving Merits: Steady growth, no worries about losses, quick cash access, low costs, and easy to start. Great if you hate risk—gives calm during tough times. Demerits: Modest returns may not always beat inflation (if rates fall), and you miss out on higher growth.

Investing Merits: Potential for big growth, beats inflation, and benefits from compounding (money makes money). Good for patient folks building wealth. Demerits: Can drop in value short-term, needs time, is more complex, and fees add up. Market dips test nerves, but spreading out helps.

Some debate: Saving misses stock booms, but investing risks crashes. Balance respects both views.

What’s Right for You

As the new year begins, the choice between saving and investing is not about choosing one and ignoring the other—it is about using both wisely. Saving provides peace of mind and protection in uncertain times, while investing helps money grow and keeps long-term dreams within reach. When balanced properly, these two habits create a strong foundation for financial stability and future prosperity. The key is to start where you are, with what you have, and move forward gradually.

Let this year be the one when intentions turn into action. Begin by setting aside a small emergency fund, then gradually explore simple and safe investment options that align with your goals and risk tolerance. Even modest, consistent efforts can yield meaningful results over time. The future is built not by big, sudden decisions but by regular, disciplined choices.

As you welcome the new year, take one clear step today—review your income, set a savings target, or learn about a basic investment option. Don’t forget to write down your financial goals and commit to revisiting them periodically. Start small, stay consistent, and allow time to work in your favor. Your future self will thank you for the decision you make today.

Leave a comment