Building a Financial Mindset

Habits and attitudes that shape long-term wealth

Most people believe that money problems begin in adulthood. In reality, money habits form much earlier—often in the teenage years. If you’re a young person reading this or a parent sharing it with your kid, you’re already taking a smart step. Building a financial mindset isn’t about becoming a money wizard overnight. It’s about adopting simple habits and attitudes early that can lead to real wealth in the long run. Think of it like planting a seed—start young, nurture it, and watch it grow into something huge.

Why bother in your youth? Time is your biggest ally. The choices you make now, like saving a little from your allowance or part-time job, can snowball into serious cash thanks to something called compounding. Getting these habits right early means you’ll avoid common pitfalls that trip up adults, like drowning in debt or living paycheck to paycheck.

This blog explains simple attitudes and habits that can help you build long-term financial stability.

-

Make Saving a Habit, Not an Option

Saving isn’t about being stingy; it’s about being smart. Start by setting aside a portion of any money you earn – aim for 20% if you can. Open a simple savings account at a bank (many have teen-friendly options with no fees). Why? Because money in your pocket tends to disappear on snacks or games, but money in the bank earns a tiny bit of profit and stays safe.

View saving as paying yourself first. Every time you save, you’re building a buffer for emergencies or fun goals, like buying a new phone without begging your parents. Track your progress in a notebook or app – seeing your savings grow is super motivating.

-

Master Budgeting – Know Where Your Money Goes

A budget is just a plan for your money. Without one, it’s easy to blow it all on unnecessary purchases. Start simple: list your income (allowance, gifts, job money) and expenses (snacks, movies, clothes). Use free apps like Mint or even a Google Sheet to track it.

At the start of each month, decide how much you’ll spend in each category. If you go over in one area, cut back in another. This teaches you to prioritize – do you really need those extra shoes, or would you rather save for concert tickets?

Budgeting isn’t restrictive; it’s empowering. It puts you in control, so you’re not surprised when your wallet is empty mid-month.

-

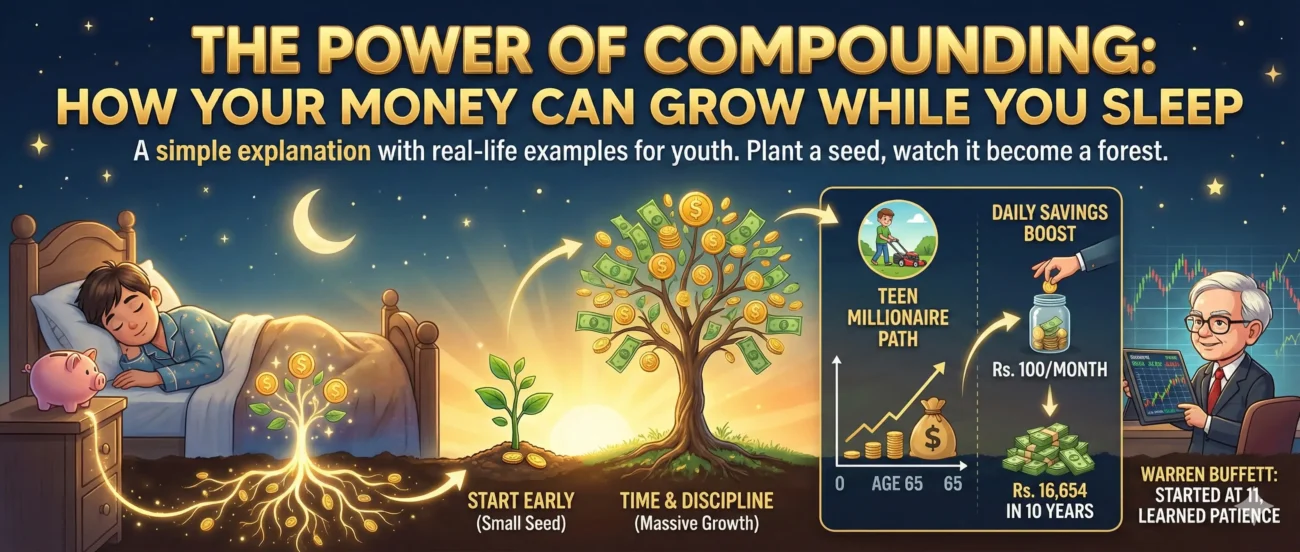

Understand Compound Effect – The Magic of Time

This is where the real wealth-building happens. If you save Rs. 100 at 5% profit, after a year, you have Rs. 105. Next year, you earn a profit of Rs 105, and so on. Over the decades, it will make you a millionaire.

Start small. Put money in a high-yield savings account or even a beginner investment (read my last week’s blog for details). The key is consistency – add a little every month.

Patience pays off. Teens have the advantage of time – starting at 16 versus 30 could mean hundreds of thousands more by retirement. It’s not about getting rich quickly; it’s about steady growth.

-

Avoid Debt as Much as Possible

Debt can be a trap, especially with credit cards. Avoid borrowing for items that lose value quickly, such as trendy clothes or gadgets.

If you must use credit, pay it off quickly. Learn about credit scores early – they’re like your financial report card and affect everything from renting an apartment to getting a job.

See debt as a tool, not a crutch. Good debt, such as a student loan for a valuable degree, can boost your earning power. Bad debt, like a loan for a trendy smartphone, just weighs you down.

-

Dip Your Toes into Investing

Investing can be intimidating, but it’s essentially putting money into assets that grow over time, such as stocks or mutual funds. You don’t need much to get started – let teens invest with parental or mentor guidance.

Educate yourself with free resources, like Khan Academy videos or books like “The Little Book of Common-Sense Investing” and “Rich Dad Poor Dad.” Start with low-risk options, such as index funds that track the whole stock market.

Adopt a growth mindset. Markets rise and fall, but historically, they grow over time. Don’t chase “hot tips” – focus on long-term, diversified investing. Mistakes are okay; learn from them.

-

Embrace Delayed Gratification

This is more a mindset than a habit, but it’s crucial. Delayed gratification means waiting for bigger rewards instead of instant ones. Skip the small, regular, and seemingly insignificant expenses to save for a trip – you’ll appreciate it more.

Set goals with timelines, like “Save Rs. 10000 in six months for a bike.” Celebrate small wins to stay motivated.

Be grateful for what you have. Comparing yourself to others on social media can lead to overspending. Focus on your progress and remember: Wealth isn’t just money; it’s freedom and security.

Final Thought

Building a strong financial mindset in your youth is like giving yourself a head start in a marathon. It’s not about perfection, but about consistent effort. Talk to your parents/mentors, read easy books on money, or join online communities for young investors. Start today, even if it’s just saving Rs. 200 a week. Over time, these habits and attitudes will shape not just your wealth, but your confidence and independence.

What are you waiting for? Be confident and get started. Share your first saving goal in the comments below – let’s build that community. Your future self will thank you. The best time to start thinking wisely about money is not tomorrow—it is today.

You are doing great job.God bless u

Thank you so much for the compliment.

Great Achievement. Keep it up Sir……

Sure. Thank you once again.

It’s really helpful, it help me a lot to take initiative, and I also share these thoughts with my students .

Thank you so much for the compliment. We cannot survive unless we adapt to a changing world. Stay blessed and happy.

Best finance blog to guide you toward smarter money decisions and long term financial success💸

You should read my blogs without fail. They will help you in creating your destiny.

Sure. Thank you once again.