Why Most Young People Struggle with Money

(And How to Break the Cycle)

In Pakistan, where youth make up over 60% of the population, financial struggles are common. From fresh graduates juggling entry-level jobs to young professionals navigating rising inflation, many struggle financially despite their best efforts. But here’s the hard truth: it’s not always about how much you earn—it’s about your mindset toward money. The problem is often not income but mindset, habits, and social pressure.

To better understand this, let us examine the issue.

The Myth: Income Alone Guarantees Stability

You’ve probably heard the advice: “Get a good job, and everything will fall into place.” But reality hits differently. Even with a decent salary—say, Rs. 50,000 to Rs. 100,000 a month—many young people end up broke by mid-month. Why? Because mindset matters more than your bank balance.

Arif Khan is a private-sector employee who also has a side hustle. He earns a modest monthly income. Although his income covers basic expenses, he never saves anything.

Most of his money goes to:

- Daily food orders

- Frequent rides instead of public transport

- Unplanned hangouts with friends

By month’s end, Arif often borrows money. Income without planning leads to stress, not stability.

The mindset issue? Viewing money as a reward rather than a tool. If you treat income as permission to spend freely, you’re trapped in a cycle of short-term gratification. Stability comes from building habits that prioritize saving and investing over immediate wants. Without this shift, even a six-figure income won’t shield you from debt or emergencies.

The Trap of Lifestyle Comparison

Social media pours fuel on the fire. Scrolling through Instagram or TikTok, you’re bombarded with influencers flaunting luxurious lifestyles—dining at high-end spots or jetting off to Dubai. What you don’t see? The debt, sponsorships, or the filtered reality behind those posts. For young Pakistanis, this creates a distorted view: “Everyone else is living large, so why can’t I?” The result? Overspending to fit in, leading to anxiety, debt, and stalled financial growth.

Sameer follows influencers and classmates on Instagram who post about cafes, trips, and gadgets. He feels his life is both boring and incomplete.

To feel included, he:

- Eats out frequently

- Buys gadgets on installments

- Spends impulsively

He is constantly worried about money, yet still keeps spending. Comparing real life with online life leads to financial confusion.

Shifting your mindset here means embracing authenticity. Recognize that true wealth isn’t flashy—it’s the freedom from worry. Focus on your goals, such as building an emergency fund, rather than seeking external validation.

The Power of Financial Discipline

If mindset is the problem, discipline is the antidote. Starting young is key because habits compound over time. Yet in Pakistan, financial education is often overlooked in schools and homes, leaving many to learn through painful trial and error.

Early discipline isn’t about deprivation; it’s about intentionality. It starts with recognizing that every rupee serves a purpose—whether for saving, investing, or spending wisely. Young Pakistanis who adopt this early often thrive.

How to Break the Cycle

Ready to change? It starts with awareness. Acknowledge your triggers—be it family expectations or fear of missing out (FOMO) fueled by friends’ stories. Then adopt a growth mindset: View financial setbacks as lessons, not failures.

Practical tips rooted in mindset:

- Budget with purpose: Use apps like Excel or local tools to categorize expenses. Treat savings as a non-negotiable “bill.”

- Build delayed gratification: Want that new gadget? Wait 30 days. This curbs impulse and rewires your brain for discipline.

- Educate yourself: Read books like “Rich Dad Poor Dad” or follow finance creators. Knowledge turns fear into empowerment.

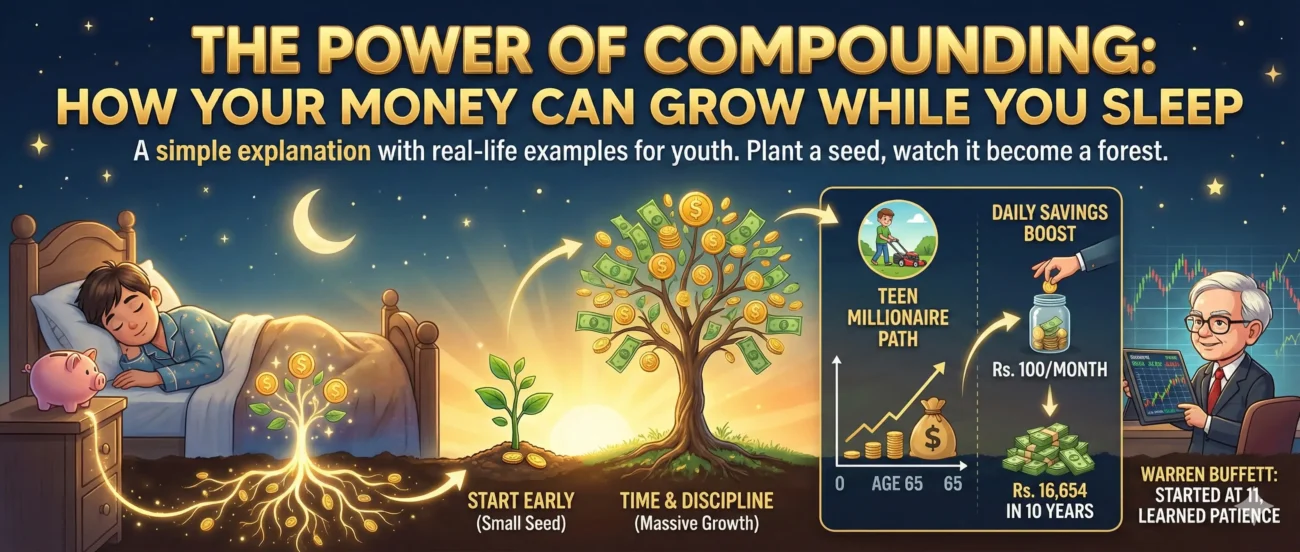

- Invest early: Even small amounts in mutual funds or stocks can grow. You may use banks for savings or Sarmaaya.pk, a Pakistan-based Fintech platform, for wealth management.

To break the cycle, reframe money as a long-term ally. Set boundaries against cultural pressures by politely declining unaffordable invitations. Counter social media by curating feeds that promote financial literacy, such as accounts focused on budgeting or Pakistani investment tips. Remember, discipline builds resilience—crucial in an economy prone to shocks like floods or political instability.

Awareness is the first step toward a better financial mindset. Track all your expenses for one week—every rupee, from transportation to snacks. Use a notebook or an app, and at the end, review: Where’s the money going? What surprises you? This simple exercise reveals leaks and builds discipline.

Most young Pakistanis struggle with money, not because they earn less, but because no one teaches them how to manage it. The earlier the awareness begins, the stronger the future becomes.

Money discipline is not a restriction—it is freedom. Start today so our future self may say thank you.

nice

You may also suggest the topics to focus on for making my blogs more beneficial to the young people.

True💯💸

Do you think this platform is helpful for people by promoting financial literacy?

Love It

Why do you love it? Please explain.