Your First Salary Is Not a Lottery — How to Manage It Wisely

Getting your first salary is an exciting moment. It’s a reward for years of studying and hard work. But remember, it’s not a lottery win—it’s the start of your financial journey. Many young people treat it like free money and later regret it. In this blog, we’ll focus on the basics of budgeting to help you manage your money wisely. We’ll cover common mistakes, a simple monthly budget for Pakistani youth, and explain the 50-30-20 rule with local examples. By the end, you’ll be ready to take control of your finances.

Budgeting Basics: Why It Matters

Budgeting is simply planning how to spend your money each month. It’s like a roadmap for your cash—it shows where your money goes so you don’t run out before payday. Without a budget, you might spend on fun things now and struggle with bills later. For young people starting jobs, this is key because salaries often start low, and expenses such as rent, food, and transportation add up quickly. The goal is to live comfortably without debt while building savings for the future.

Common Mistakes After Receiving Your First Salary

It’s easy to get carried away with that first paycheck.We all mess up at first—here’s what to watch for, with stories that’ll make you chuckle (and learn):

- Impulse shopping sprees: Sara in Karachi gets her Rs. 45,000 marketing gig paycheck and heads to Dolmen Mall for “essentials” like trendy sneakers and makeup. Next thing she knows, her account’s empty, and she’s eating instant noodles for dinner. Lesson: The “sale” on Daraz or any other platform isn’t a need—wait 24 hours before buying.

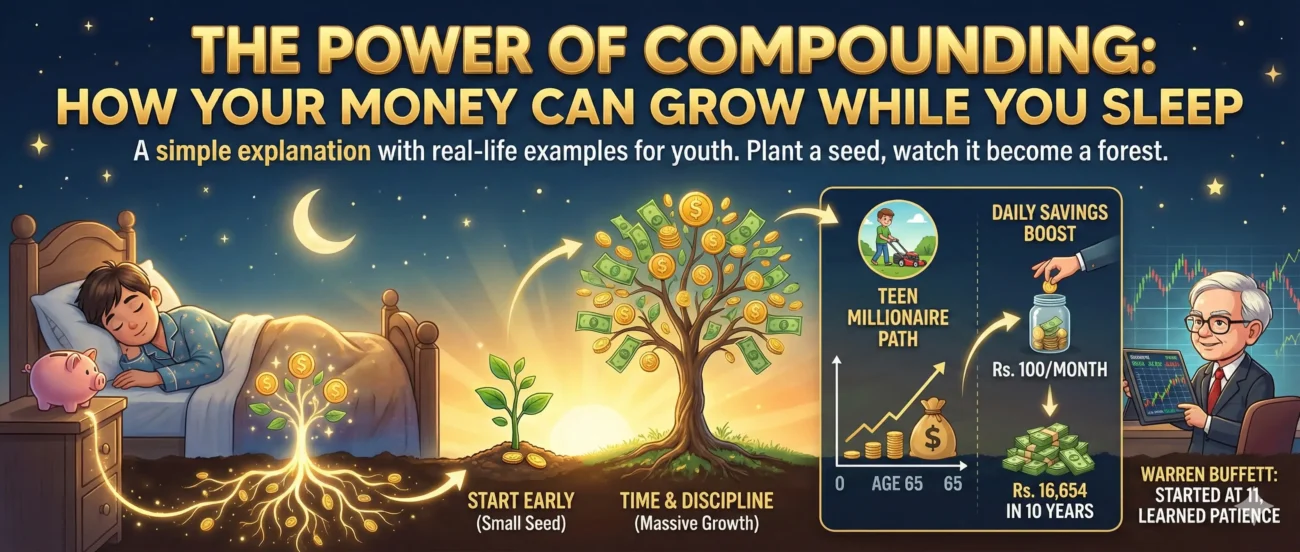

- Zero-savings mindset: Think “I’ll save later”? Meet Ahmed from Lahore, who spent his first Rs. 50,000 on outings and parties. When his bike broke down on a hilly road, he had to pawn his watch. Pro tip: Automatically save 10% into a savings app or a bank account.

- Credit card traps: Fatima, a recent accountant in Islamabad, swipes for a fancy dinner at Monal—interest piles up faster than traffic on GT Road. In Pakistan, rates can reach 25%, turning Rs. 5,000fun into a debt of Rs. 6,250.

- Invisible small spends: Those daily Rs. 50 samosas from the local vendor? They add up. Bilal in Mansehra tracked his spending and found he spent Rs. 3,000 a month on snacks alone—enough for a month’s gym membership.

- Overlooking family duties: Many of you support your families at home. Usman forgot to budget Rs. 10,000 for his parents’ medicine and ended up stressed mid-month.

The fix? Laugh at these stories, then use a notebook or a free app to log every expense. It’s like having a financial sidekick.

A Simple Monthly Budget for Youth

Let’s make this practical. Suppose your first salary is around Rs. 50,000 (a common entry-level pay for graduates in Pakistan, in IT or teaching jobs). Here’s a basic budget breakdown:

- Income: Rs. 50,000 (after taxes and deductions).

- Fixed expenses (must-pays): These are bills you can’t skip.

- Rent or home contribution: Rs. 10,000-15,000.

- Utilities (electricity, gas, water): Rs. 3,000-5,000.

- Transport (bus, bike fuel): Rs. 3,000-5,000.

- Mobile and internet: Rs. 1,000-2,000.

- Total fixed: Around Rs. 16,000-26,000.

- Daily needs (food and basics): Groceries and meals: Rs. 8,000-10,000 (cooking at home saves money; eating a simple meal instead of biryani daily).

- Savings and emergencies: Aim for at least Rs. 5,000-10,000 in a savings account.

- Fun and extras: Rs. 5,000 for movies, hanging out, or hobbies—keep it limited.

- Family support: Rs. 5,000 if needed.

Adjust based on your city. In Abbottabad or other tier-2 or tier-3 cities, costs might be lower (rent around Rs. 8,000), but in Islamabad, they’re higher. The key is to list your actual expenses and ensure spending doesn’t exceed income. Use free apps to track your expenses.

The 50-30-20 Rule Explained in Local Context.

This is a popular budgeting rule among financial experts: Divide your after-tax salary into three parts—50% for needs, 30% for wants, and 20% for savings or debt.

- 50% for needs (essentials): Half your money goes to must-haves like rent, food, transportation, and utilities. For a Rs. 50,000 salary, that’s Rs. 25,000. In Pakistan, this covers basic expenses—think paying electricity bills, buying atta and veggies from the market, or paying your public transport fare. If costs rise (like during inflation), cut non-essentials first.

- 30% for wants (fun stuff): This is for enjoying life—30% or Rs. 15,000. For example, eating out, buying a new dress for Eid, or paying cable bills. But don’t confuse wants with needs—skip the expensive outing if it pushes you over the limit.

- 20% for savings/debt (future security): At least Rs. 10,000 goes here. Put it in a bank savings account (earning 10-15% profit in Pakistan) or pay off a loan. This builds an emergency fund for things like wedding expenses or job loss.

In the Pakistani context, adjust for cultural factors: Many save for family events or remittances. If your salary is lower (say Rs. 30,000 for starters in retail), prioritize needs and savings. The rule is flexible—start with 60-20-20 if needs are higher.

Create your Monthly Budget

Now it’s your turn.Pick up a pen and paper or open a spreadsheet. List your expected salary, then jot down expenses in the 50-30-20 categories. Track for one month and tweak as needed. Remember, starting early sets you up for long-term success. Share your budget in the comments or with friends—let’s build better habits together. If you stick to this, your first salary won’t be a one-time thrill but the foundation of financial freedom

Wonderful information ❤️