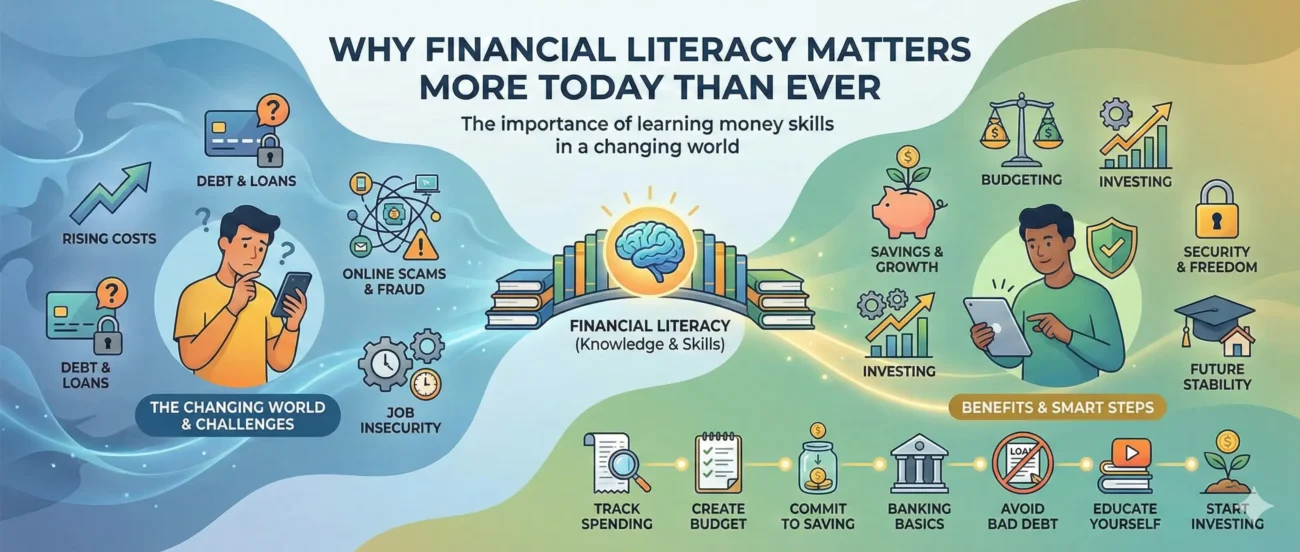

Why Financial Literacy Matters More Today Than Ever

The importance of learning money skills in a changing world

In today’s fast-changing world, money works very differently than it did just a few years ago. Prices rise quickly, new technologies change how we earn and spend, and financial decisions have become more complicated. In this environment, financial literacy—understanding how money works—has become not just helpful but essential for everyone, especially young people.

Financial literacy means knowing how to manage your money responsibly. It covers skills such as budgeting, saving, investing, using a bank account, avoiding unnecessary debt, and planning for the future. You don’t need a degree in finance to be financially literate; just basic knowledge and good habits are enough.

1) Why It Matters More Today

There are several reasons why financial literacy has become more important than ever:

- Rising Cost of Living: The prices of education, healthcare, groceries, and rent (almost everything) are going up. Without good money management, people find it hard to meet their needs, or they rely on loans. Financial literacy helps you stay in control even as prices increase.

- Easy Access to Loans and Credit: Today, banks, apps, and credit companies offer loans with just a few clicks. This is convenient, but it can also be dangerous if you don’t understand interest, repayment, or hidden charges. Many people fall into debt traps simply because they didn’t know how credit works.

- Online scams and fraud: As digital payments become common rapidly, so do online scams. Being financially literate helps you protect yourself from fraud, fake investment schemes, and misleading advertisements.

- New Ways of Earning and Investing: Freelancing, e-commerce, online businesses, stocks, mutual funds, and digital wallets—these are all emerging opportunities. But to benefit from them, you need to understand how money flows in this digital landscape. Financial literacy provides you with the confidence to explore new income sources safely.

- Lack of Job Security: The job market is unstable. Companies change rapidly, and technologies replace certain skills. Having money management skills helps you save money, prepare for unexpected events, and stay financially secure even during tough times.

2) How Financial Literacy Helps You

- Better Decision-Making: When you know how money works, you make smarter choices—whether you’re buying a phone, investing in a business, or choosing a loan.

- Reduced Stress: Money problems cause stress. Financial knowledge helps you stay calm because you have a plan and control over your finances.

- Improved Savings and Investments: People who understand finances save more and grow their money through secure investments rather than relying solely on their salary.

- More Freedom and Independence: When you handle your money responsibly, you won’t have to depend on others. You can support yourself and your family well.

- Simple Steps to Become Financially Literate

You don’t need to learn everything in one day. Start with small steps:

- Monitor Your Spending: Keep a daily record of expenses to identify patterns and cut waste.

- Develop a Budget: Create a simple monthly plan to allocate income toward needs, wants, and savings.

- Commit to Saving: Regularly set aside at least 10% of your earnings.

- Master Banking Basics: Familiarize yourself with accounts, digital payments, and secure online transactions.

- Steer Clear of Impulsive Debt: Evaluate loans carefully and avoid unnecessary borrowing.

- Seek Educational Resources: Read books, watch videos, or take free online courses on personal finance.

- Start Investments: Once you feel confident, start with low-risk options to grow your money.

Financial literacy isn’t just for businessmen or experts. It’s for every student, employee, homemaker, and entrepreneur. The world is changing rapidly, and knowledge of money management is one of the most vital life skills today. The sooner you start learning, the stronger your financial future will be.

If you develop good money habits today, they will help you throughout your life.

This is really helpful, govt must introduce subject on financial literacy UpTo BS level. Students along with degree think about different skills and not only relay on govt job . They think in various dimensions.

Win999club is alright! I was skeptical at first, but I ended up sticking around for a few hours. Nice variety of games to pick on. Gonna keep it on my radar. Give it a try! win999club

Downloading fb77705download now. Fingers crossed this download is smooth and worth it! Will update soon. Grab it here – fb77705download

Trying to login to jilievoclublogin. Hope it’s easy! Anyone else a member? Let’s get this bread. Try logging in here – jilievoclublogin

Alright, time for some judi bola with 828bet nih! Anyone else into this? Kasiyakan toh! Let’s go! Check it out, bro – judi bola 828bet nih