New Money Habits: One Decision That Can Change Your Financial Life

Sameer, have you ever looked at your bank account and wondered where all your money went? Or daydreamed about that epic road trip across Pakistan, only to feel it’s a pipe dream? You’re not alone—most of us in Pakistan juggle bills, temptations, and that sneaky urge to spend. But what if I told you one decision could boost your finances and transform you from a spender into a wealth builder? No magic tricks, no overnight riches—just a game-changing habit that feels personal and doable.

That habit is paying yourself first. It’s like hitting the reset button on your financial life. Forget boring lectures; we’re talking about daily habits that stick, a mindset shift that fires you up, and real-talk examples for young hustlers like you. Ready to dive in? Let’s make your wallet work harder—starting now!

What Does “Pay Yourself First” Mean?

Picture this: Your paycheck hits, or that freelance gig pays out—the first move is to “separate some cash for you.” After paying yourself, pay the landlord, the latest smartphone upgrade, or that irresistible party. You first. It’s changing the script from “spend now, save later” to “save now, spend smarter.”

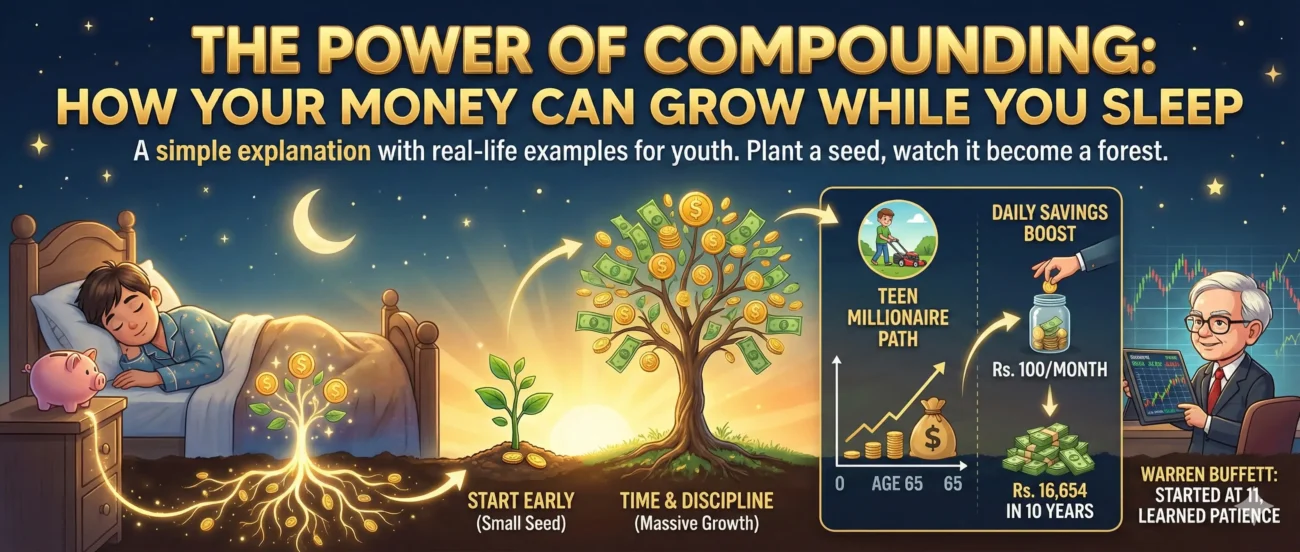

Why’s this a total game-changer? Without it, money slips through your fingers like sand. But do it right, and you’re building a fortress—emergency funds, dream vacations, even early retirement vibes. For young folks in their 20s, imagine ditching the stress of family expectations. Start small and watch it snowball. Trust me, it’s the financial glow-up you didn’t know you needed.

Change your Mindset

Okay, let’s get real—money isn’t just numbers; it’s a mindset. We’re bombarded with ads screaming, “Buy this NOW!” and friends posting photos of their lavish parties on social media. It’s tempting to chase that instant high. But paying yourself first? That’s your power switch. You go from thinking “I deserve this treat” to “my future deserves security.”

Meet Ali, a 26-year-old from Peshawar, just like you. He used to blow his salary on late-night gaming sessions and impulse buys from online stores. Debt piled up, and stress skyrocketed. Then he tried paying himself first—auto-saving 15% off the top. At first, it felt like torture! “What if I need that cash?” But soon, the shift hit: seeing his savings app notify “Balance up!” felt better than any quick win. Now he has funded a side hustle through freelancing and no longer lives paycheck to paycheck. You could be next—ask yourself: What if your money started multiplying instead of disappearing?

A professional tip: Start your day with a quick affirmation, “Today, I start building my empire.” Sounds cheesy? It works—turning money from a headache into something you’re excited about.

Daily Habits

Habits aren’t about perfection; they’re about momentum. Make paying yourself first a no-brainer with fun, bite-sized routines. No finance PhD required—just your phone and a dash of discipline.

- Kick off your day with a 2-minute app check-in. See what you saved yesterday? Instead of seeking external approval, acknowledge your own efforts and worth. It’s like leveling up in a game—addictive and rewarding.

- Set up auto-transfers in your bank app (easy with apps like Easypaisa or JazzCash). 10% goes to your savings before you blink. Youth hack: Treat it like locking away power-ups in PUBG—you’ll thank yourself later.

- Before bed, review your spending. Spot any unnecessary expenses? Laugh it off and redirect next time. Make it a challenge: “Beat yesterday’s savings!”

These aren’t chores—they’re your secret weapons. Stick with them, and you’ll feel the rush of control. Who knew that practicing responsible adult behavior could be this exciting?

Roadmap to Start TODAY

Excited yet? Let’s turn hype into action. Here’s your foolproof plan—simple and zero overwhelm. Grab a coffee (or a cup of tea), and let’s roll.

- Tally your monthly income (job, side gigs, even pocket money). Pick 10% to start. Is that doable, or too steep? Drop to 5% if it’s difficult and ramp up later.

- Open a separate savings account (online banks make it painless). Bonus: Look for accounts with high profit margins to grow your cash.

- Stop unnecessary expenses—like that unused Netflix subscription or extra data plans. Redirect those savings to your “me fund.” Instant win!

- Dream Big. Make it personal—save for a new car, a family trip, or even Umrah. Please write it down and pin it on your wall.

- Review weekly: Sunday ritual: Check progress, celebrate (maybe with a small treat), and tweak as needed. And hey, learn on the go—YouTube Shorts or financial literacy books on “easy investing” are gold.

Mess up? No problem—dust off and dive back in. This is your journey, not a test.

Hey, youth. Your one decision holds endless possibilities. Paying yourself first isn’t just smart; it’s liberating. Shift your mindset, nail those habits, follow the steps, and boom—your financial life goes from “meh” to “masterpiece.” Imagine stress-free Eid, funded adventures, and the confidence to chase big dreams.

What’s your first move? Set that auto-save right now, or share in the comments: What’s one habit you’re ditching? Let’s chat—your story might inspire someone else. You’ve got the power. Let’s build better money habits together.

Love It

Sahil, keep on reading for your growth. You can also suggest topics for new blogs, so I can assist you further.

This is exactly the wake-up call I needed! The concept of ‘Paying Yourself First’ is a total mindset shift. I’m ditching my habit of ordering late-night food and setting up that auto-transfer on my banking app today. Thanks for the practical roadmap!

Make reading a habit to grow, and do pay yourself first if you want to create your own destiny.

Yo, TBJILI is my go-to spot! Always got the newest games and the bonuses are legit. Been cashing out pretty regularly, no cap. Check it out tbjili, you might get lucky too!

Okay, SuperKingPHcom… It’s alright. Not the flashiest, but it gets the job done. Decent games, could be better promos tho. Try it superkingphcom if you’re bored.

1PHBetLogin makes it easy to get in and play. No complicated stuff. If you want simple, check it 1phbetlogin.