Introduction to Investing: How Young People Can Start Small

Money grows when it is given the right direction. If you’re in your teens or twenties, the word “investing” might sound complicated, risky, or something meant only for rich adults. But guess what? It’s not. Investing is basically putting your money to work so it can grow over time, and it’s something anyone can start—even if you don’t have a ton of cash. I’ve seen many people who’ve gone through the ups and downs of starting small. In this blog, I’ll break it down step by step, so you can dip your toes in without feeling over whelmed. The earlier you begin, the easier your financial journey becomes.

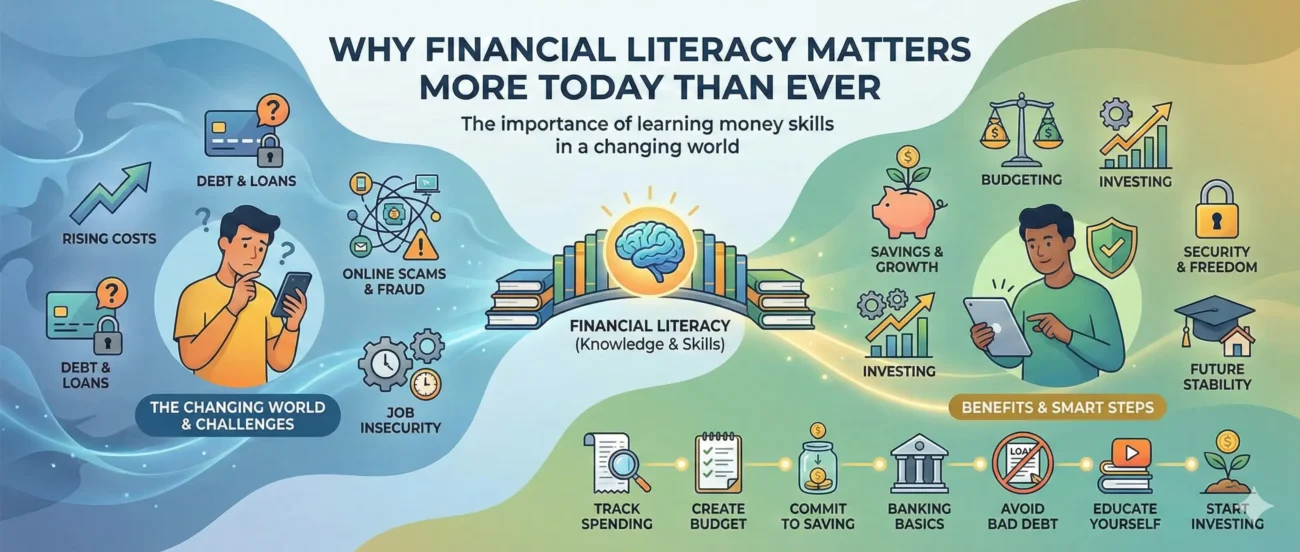

Why Investing?

When you’re young, time is your biggest advantage. You have decades ahead for your money to grow through something called the compound effect. It’s like a snowball rolling down a hill—it starts small but grows bigger as it picks up more snow. It’s a process in which your money earns profit, and that profit also earns more profit. Over long periods, the results can be surprising.

Imagine if you invest Rs 1000 a month starting at age 20, by the time you’re 40 or 50, that could grow significantly depending on market performance. Wait until you’re 30, and you’ll need to invest much more to catch up. The key? Starting small and staying consistent. Plus, with today’s apps and online tools, it’s easier than ever—no need for a fancy broker or a briefcase full of cash.

How to Get Started?

Investing means buying things that you think will increase in value over time or pay you back regularly. It’s not gambling; it’s about making smart choices based on research.

Here are some beginner-friendly choices that young people can understand easily:

- Stocks: These are small pieces (shares) of a company. If the company performs well, your stock value might increase, allowing you to sell it for a profit. Buying shares in good companies can help your money grow faster, but it requires patience and basic knowledge. Start slow and focus on solid companies instead of chasing quick profits.

- Bonds: Safer than stocks. You’re essentially lending money to a company or government, and they pay you back with interest. Schemes such as national savings accounts or youth-focused plans give stable returns. These are ideal for people seeking low risk.

- Mutual Funds or ETFs (Exchange-Traded Funds):These are collections of stocks or bonds combined into one investment. They’re ideal for beginners because they spread your money across many assets, which lowers risk. You don’t need to pick individual winners—just invest in the entire group. It’s simple, low-stress, and perfect for those new to investing.

You don’t need thousands of rupees to begin investing. Even savings from pocket money, part-time jobs, or small earnings can be used. What matters is not the amount; it’s the habit. Many platforms let you start with a small amount.

Remember, investing involves risk. The market rises and falls, but historically, it tends to increase over time. Start with whatever you can afford—Rs. 500, Rs. 1,000, or Rs. 2,000 per month. Later, as your income grows, you can raise your investments.

Tips for Young Investors

- Educate Yourself: Read books such as “The Little Book of Common-Sense Investing” by John Bogle or watch free YouTube channels like Khan Academy’s finance series. Knowledge is your best tool.

- Diversify: Avoid putting all your eggs in one basket. Mix stocks, bonds, and perhaps some international investments to spread out the risk.

- Be Patient: Investing isn’t a get-rich-quick scheme. Think years, not days. Ignore the hype on social media about crypto or meme stocks—those can be fun but risky.

- Track and Adjust: Review your investments a few times a year, not daily. Life changes, so make adjustments as needed.

- Start Now: Every month you delay, you lose valuable compounding time.

Common Pitfalls

I’ve noticed many people make these mistakes:

- Chasing trends: Just because everyone’s talking about a hot stock doesn’t mean it’s a good idea.

- Panicking during dips: Markets crash sometimes, but they recover. Selling your shares on low price is the worst move.

- Ignoring fees: Choose low-fee options; even small fees can eat into your gains over time.

- Forget about taxes: Know the basics, so you’re not caught off guard by tax authorities.

Your Next Step

Investing isn’t magic—it’s a mindset. It may seem frightening at first, but starting small as a young person is one of the smartest moves you can make for your future self. It’s about forming habits now that will pay off significantly later. When you start early, you create a future where money works for you; instead, you are working for money.

If you have questions or want to share your own starting story, leave a comment below. What’s holding you back from investing today? Let’s talk.

Stumbled upon shbetf and thought I’d try my luck. Alright site, nothing too fancy but does the job. Decent odds on football. Will keep an eye on it. shbetf